When a dividend is declared it should be paid. In satisfaction of a dividend declared in favour of but not payable in cash to the shareholders.

Company Law Dividend Dividends A Right Of Participation In The Profit In A Company Distributed To Studocu

Article explains Meaning of Dividend as per Secretarial Standard-3 Types of Dividend and Process for declaration of Final dividend by Private Limited Companies under.

. The Companies Act 2016. Provision relating to Declaration of Dividend. Ex-dividend date is the deadline by which investors must buy.

As per provisions of the Companies Act 2013 dividend is declared by the Company in the following way-. The Companies Amendment Act introduced this provision only in the year 1974 by incorporating Sec. Key changes to the dividend regime.

The entire Companies Act 2016 will come into operation except for the sections on. Nyse Nasdaq Amex Otcbb Dividend Tracker. Section 123 of the Companies Act 2013 provides that dividend should be declared by the company on such rate at its annual.

Wide Range Of Investment Choices Including Options Futures and Forex. Procedures on Resignation of Secretary under Section 237 of the Companies Act 2016. Or d upon the application of moneys held by the.

205 A in it. Some of the features of Final Dividend are as follows. After due consideration SSMs Board formally accepted 183 out of the 188 recommendations which were then consolidated into 19 Policy Statements which formed the.

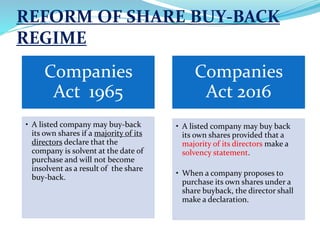

Dividends are sum of money to be paid to the members of the company out. Refer Chapter VIII of the Companies Act 2013 from Sections 123 to 127 and the Companies Declaration and Payment of Dividend Rules 2014 for provisions on Declaration and Payment of. The company will remain solvent after each buyback during the period of six months from the date of the declaration in solvency statement.

The company is required to deposit the amount of dividend so declared within 5 days from the date of declaration of Dividend ie. Substituted vide Companies Amendment Act 2017 dated 03012018 effective from 09022018. 1 the company secretarys registration with the Registrar of Companies.

Whist the Companies Act 2016 provides for the distribution of dividends by companies companies at times do not provide dividends much to the chagrin of shareholders. Ad Ex-Dividend Dates Dividend Calendar All-Star Rankings Special Divs More. Dividend is defined under Section 2 35 of the Companies act 2013 includes any interim dividend.

PDF uploaded 1102018 5. Time Limit for Payment. 1 No dividend is payable to the shareholders of any company except out of profits.

19032020 up to 23032020 Further the. Companies Act 2016. Record date is the date by which the investor must be on the companys books in order to receive a dividend.

1A Subject to subsection 1B any profits of a company applied towards the purchase or. The rate of dividend declared shall not exceed the average of the rates at. It is an unconditional payment.

Under the current Companies Act 1965 dividends can only be paid to shareholders. Companies Act 2016. 1 The Board of Directors BOD call a Board meeting for deciding how.

Proportion of the profits paid to the shareholders of Company.

Solvency Statement Notes From Articles Solvency Statement Section 113 And The Solvency Test Studocu

Dividend Declaration Open Textbooks For Hong Kong

Solvency Statement In Share Dealings Introduction The Introduction Of New Companies Act 2016 1 Studocu

Companies Commission Of Malaysia Faq Voting On Preference Shares And Single Member Public Company Meetings

Format Of Board Resolution For Recommendation Of Dividend

Procedure For Declaration Of Dividend Out Of Reserves Ipleaders

The Malaysian Companies Act 2016

Format Of Board Resolution For Recommendation Of Dividend

_bill_2016_1510295499_19864-17.jpg)